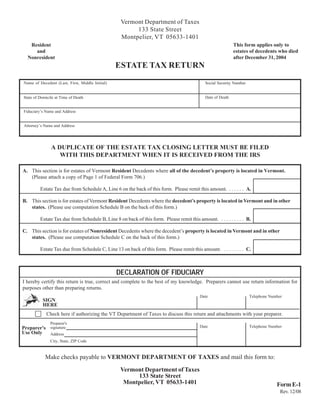

vermont department of taxes forms

W-4VT Employees Withholding Allowance Certificate. Use myVTax the departments online portal to e-file and submit Form PTT-172 Property Transfer Tax Return with the Department of Taxes and the.

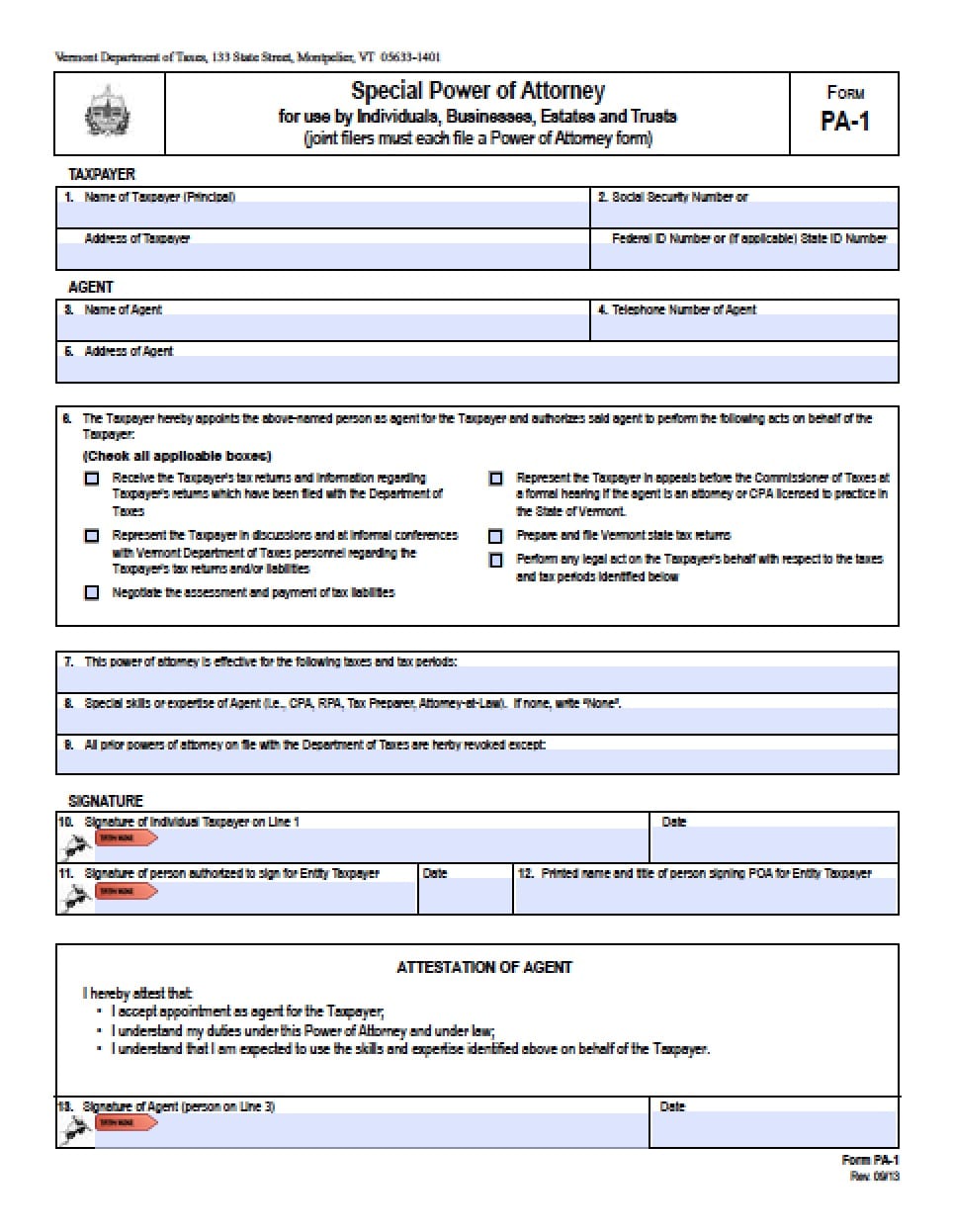

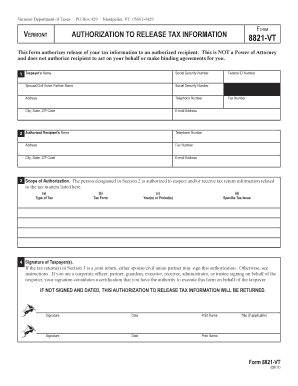

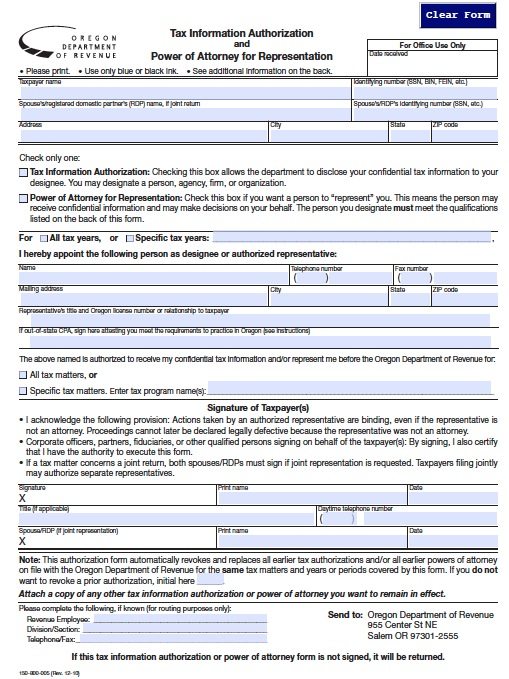

Vermont Tax Power Of Attorney Form Power Of Attorney Power Of Attorney

Send this form and your Advance Directive to the Vermont Advance Directive Registry to store it electronically so hospitals or other.

. Web Freedom and Unity. Engaged parties names places of residence. Taxes for Individuals File.

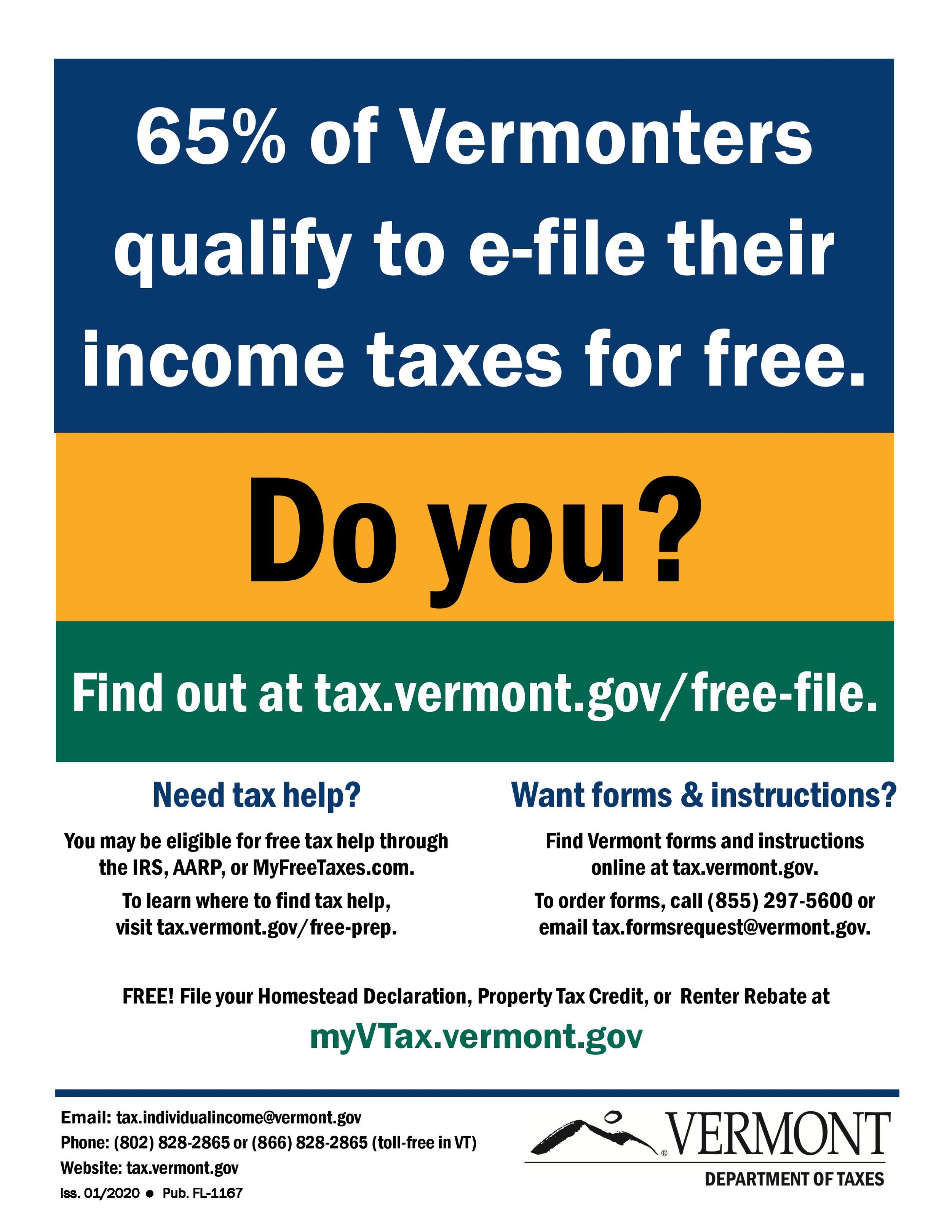

These are available in any of our offices. Vermont has a state income tax that ranges between 335 and 875 which is administered by the Vermont Department of Taxes. IN-111 Vermont Income Tax Return.

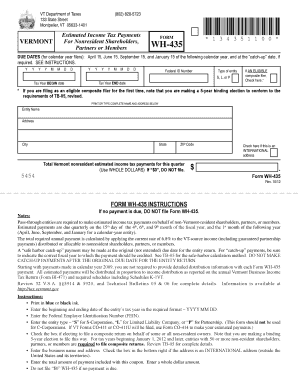

Web Form IN-114 - Estimated Income Tax. W-4VT Employees Withholding Allowance Certificate. Web Department of Taxes.

Web Tuesday November 1 2022 - 1200. SUT-451pdf 17703 KB File Format. Web Register or Renew a Vehicle Find all of the resources you need to register and renew your vehicle in Vermont.

Web IN-111 Vermont Income Tax Return. Web Created in collaboration with the Vermont Department of Disabilities Aging Independent Living and the Vermont State Police. Form SUT-451 Sales and Use Tax Return.

Web Advance Directive Forms. PA-1 Special Power of Attorney. Fill the blank areas.

Open it using the cloud-based editor and begin editing. Web Vermont has a state income tax that ranges between 335 and 875 which is administered by the Vermont Department of Taxes. Do you have questions about a tax bill you may have.

You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Web The Vermont Department of Taxes offers several eServices for individual taxpayers and businesses through myVTax the departments online portal. Taxes for Individuals File and pay taxes online and find required.

Web Vermont has a state income tax that ranges between 3350 and 8750. Web The 1099-G is a tax form for certain government payments. Every January the Vermont Department of Labor sends 1099-G forms to individuals who received unemployment.

Web This is the tax form which shows every month of the year when you and your family members had a qualified health plan QHP with Vermont Health Connect VHC. PA-1 Special Power of Attorney. Web Find the Vermont Department Of Taxes Form you require.

Estimated tax payments must be sent.

Vermont Department Of Taxes If You Are Selling Or Closing A Business You Can Close Your Tax Accounts At Myvtax Vermont Gov Tax Accounts And Business Licenses Are Not Transferrable To The New

Form 250 Act 250 Disclosure Statement

Vermont Department Of Taxes Facebook

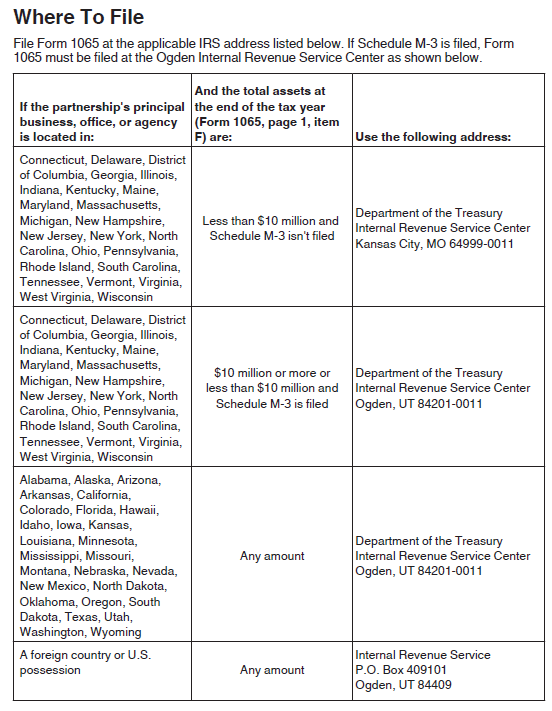

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

Filing Your Investment Club Taxes Bivio Investment Clubs

/cloudfront-us-east-1.images.arcpublishing.com/gray/WLAG4ZHFR5GGJLZ5LUNEEVCDSU.jpg)

State Vermonters Should Receive New 1099 G Forms By Friday

2021 Military Tax Forms Release Schedule Download W 2 1099 R 1095

Vt Tax Dept Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Sun Community News Montpelier The Vermont Department Of Taxes Last Week Mailed 1099 G Forms To 21 000 Taxpayers That

8879 Vt C Fill Out Sign Online Dochub

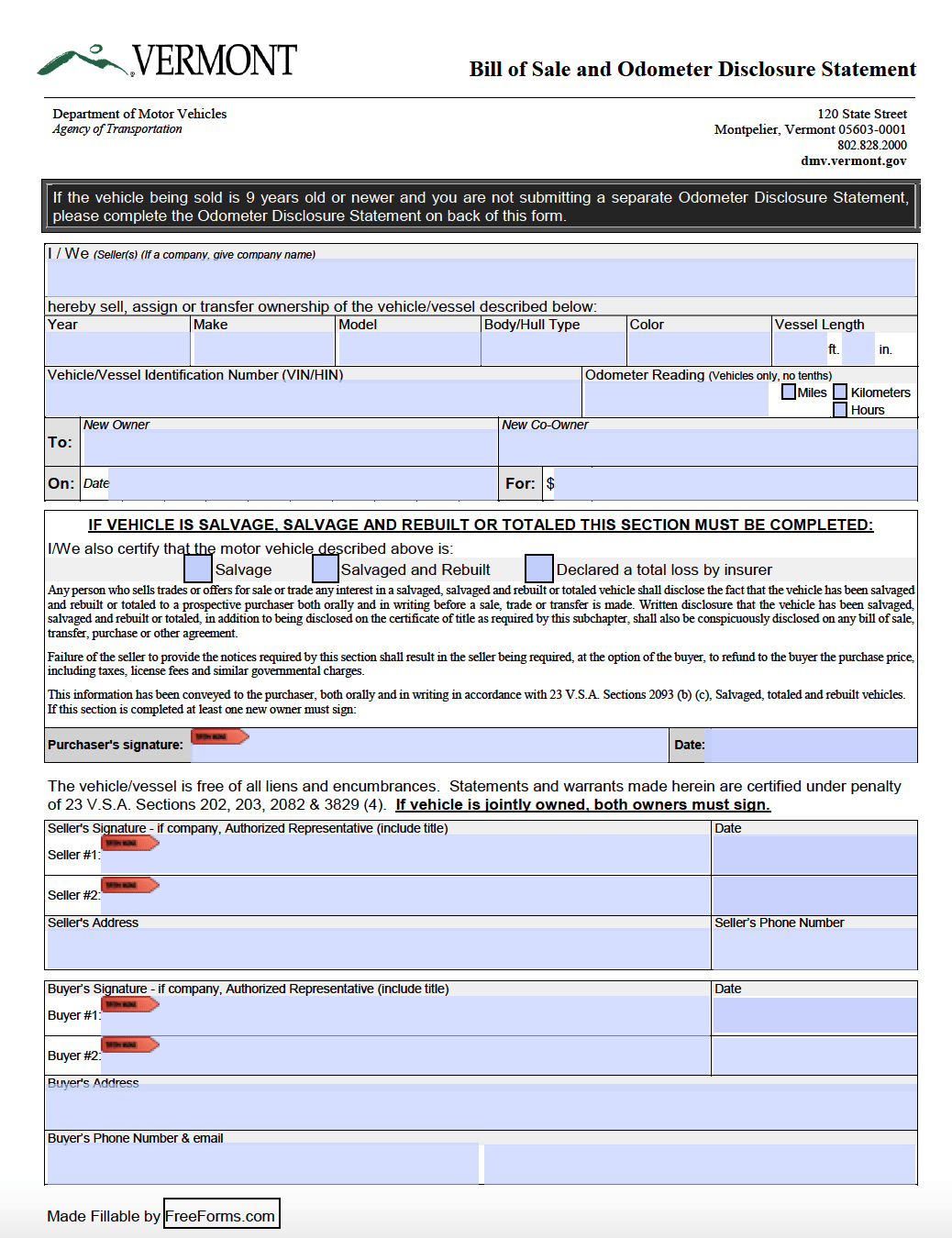

Free Vermont Motor Vehicle Vessel Dmv Bill Of Sale Form Pdf

Vermont Department Of Taxes Form Fill Out And Sign Printable Pdf Template Signnow

Free Tax Power Of Attorney Oregon Form Pdf

Vermont Tax Forms And Instructions For 2021 Form In 111

What New Employee Forms Do I Need For A New Hire

Wisconsin Tax Forms And Instructions For 2021 Form 1

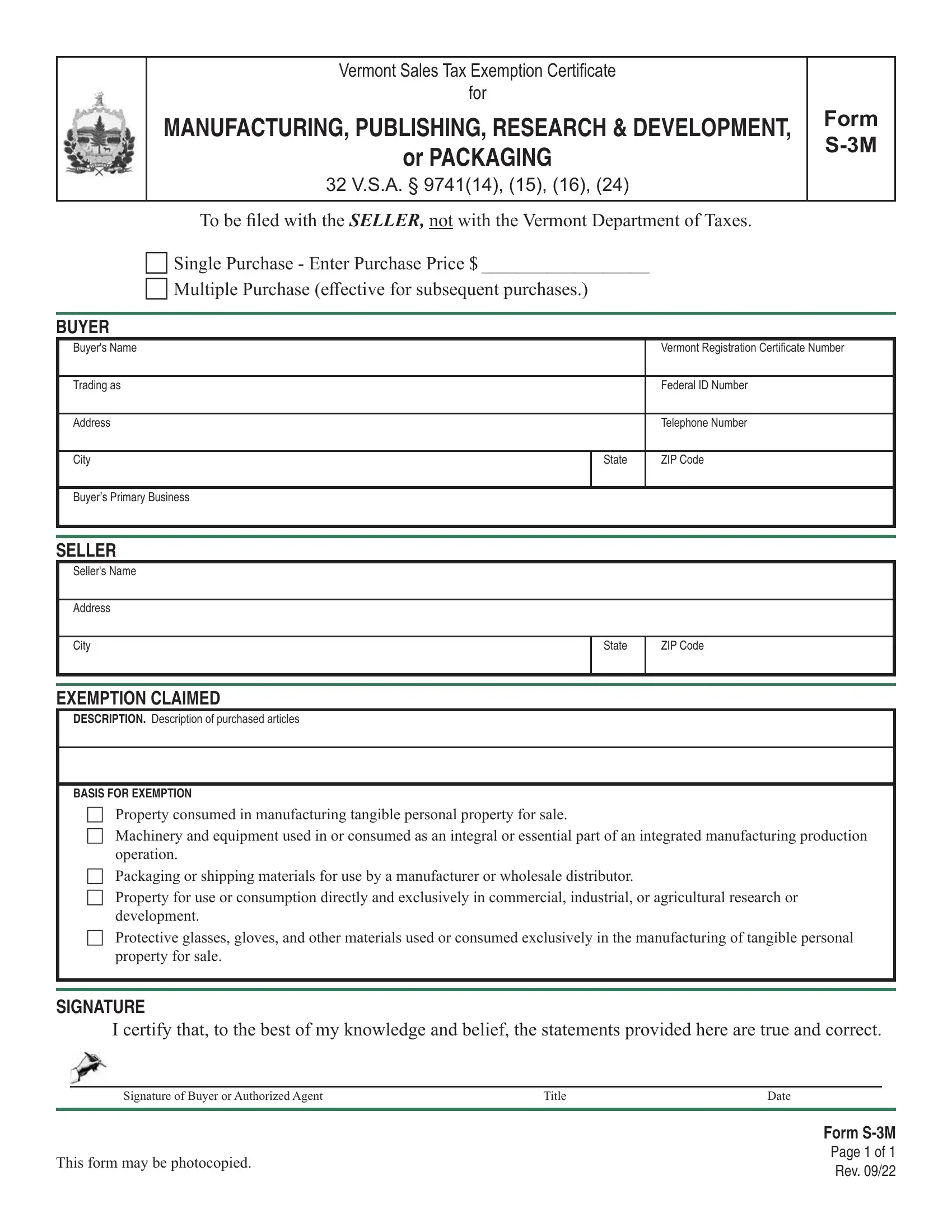

Form S 3m Vermont Fill Out Printable Pdf Forms Online

Vermont Department Of Taxes 133 State Stmontpelier Vt 05633 1401united States Of America Fill Online Printable Fillable Blank Pdffiller