GST increase Singapore 2022

The above fee applies to Singapore Citizens Singapore Permanent Residents and International Students. 4225 What will 2022 be like for you.

The standard rate is currently 7 percent but is expected to increase to 9.

. GST PCT 3 This form is a notice that seeks additional information from a GST practitioner on the enrollment application. What is GST how it works. London Energy Forum 2022.

With tax reforms such as faceless assessment taking roots 2021 will go. This ensures that everyone at all levels of the sport continues to have a positive experience in tennis. Even with the impact of the heightened alert measures in July and August the economy expanded by 71 year over year and 13 quarter over quarter in the third quarter.

Rate of taxation When it comes to GST vs VAT tax VAT is typically higher than GST. The only exemptions are for the sales and leases of residential properties importation and local supply of investment precious metals and most financial services. First announced in the Budget 2018 GST is expected to increase from 7 to 9 from 2022 to 2025.

The Centres notification to hike GST rates for several textile and apparel items from January 2022 has come as major blow to micro small and medium-scale textile and clothing units with. SGD 68000 exclusive of GST payable over 4 semesters. It is an Indirect tax which introduced to replacing a host of other Indirect taxes such as value added tax service tax purchase tax excise duty and so onGST levied on the.

2 days agoExcluding Goods and Services Tax GST the tariff for households will go up from 2411 cents to 2544 cents per kWh for the quarter ending Mar. On top of these abovementioned areas we should expect to incur higher expenses not only due to inflation but also because of the planned increase in Goods and Services Tax GST. 31 2022 before factoring in Goods and Services Tax GST.

The private residential and public housing resale markets have been buoyant despite the economic impact of COVID-19 the government said in a statementPrivate housing prices have risen by about 9 since the first. Getting the details right in 2022 will be no easier -- but a few broad themes are likely to persist. Kick-start International Energy Week by joining us for the SP Global Platts London Energy Forum 2022.

GST stands for Goods and Services Tax. 3130 The new norm. GST PCT 2 This form is a certificate of enrolment which is issued by an authorized officer for you to be able to start work as a GST practitioner.

Government Social Safety Net. 3929 The future of employment and the Singapore job market. According to a report by the National Council of Applied Economic Research GST is expected to increase economic growth by between 09 per cent and 17 per cent.

Exempttax-free items Its also worth noting that some goods which are exempt from VAT may not be exempt from GST and vice. The Inland Revenue Authority of Singapore IRAS will be revising the Annual Values AVs of HDB flats upwards by 4 to 6 with effect from 1 January 2022 in line with the increase in market rentals. Singapores economic recovery from the pandemic has been faster than what the economists predicted at the start of 2021.

2 days agoThe tariff for households will go up from 2411 cents to 2544 cents per kWh for the quarter ending Mar. The Goods and Services Tax GST implemented on July 12017 is regarded as a major taxation reform till date implemented in India since independence in 1947. SINGAPORE TENNIS ASSOCIATION SAFE SPORT STATEMENT.

Singapore announced a package of measures to cool its property market on Wednesday including raising stamp duties and tightening loan limits. 2100 Helping your fellow Singaporean. February 21 2022 830 am - 400 pm GMT.

A record GST tax collection an overhaul of the income tax return filing portal and the landmark move to scrap retrospective taxation have set the stage for the next level of reforms in tax administration that include bringing a framework for cryptocurrencies and rationalising the GST rate structure. The tax structure is much simpler and easier to understand. SGD 68000 exclusive of GST payable over 2 semesters.

Here are the details for NUS MBA Fees for the academic session 2021-2022. GST in Singapore is a broad-based value added tax levied on import of goods as well as nearly all supplies of goods and services. NUS MBA Fees 2021-2022.

SINGAPORE Finance Minister Lawrence Wong will deliver Singapores FY2022 Budget Statement on Friday 18 February 2022 in Parliament. It was announced in the 2018 Budget that this rate would be increased to 9 sometime between 2021 and 2025. GST is charged at 7 on the supply of goods and services made in Singapore by a taxable person in the course or furtherance of ones business and the importation of goods into Singapore.

The AV revision is part of IRAS annual review of properties to compute the property tax payable. Covid-19 Pandemic developments have been the markets main driver for almost two years causing a crash in 2020 and then a sustained rally on the back of vaccination programs that allowed an economic reopening. GST is a destination based tax as against the present concept of origin based tax.

They have also pegged Singapores benchmark Straits Times Index STI at a year-end target of 3550 points for the FY2022. Whereas the rate of VAT in the UK is 20 the rate of GST in Australia Singapore and Canada is 10 7 and 5 respectively. 2500 Elderly who cant afford to retire.

The Singapore Tennis Association STA is committed to providing a safe diverse and equitable environment to all members of the tennis community in Singapore. Generally GST is chargeable at the prevailing standard rate on any supply of goods and services made by a GST-registered entity in the course or furtherance of its business. SINGAPORE - The plan to raise the goods and services tax GST between next year and 2025 remains unchanged Finance Minister Lawrence Wong.

Park Plaza Westminster Bridge Hotel London Online. GST To Increase After 2022. On this the analysts say they are positive on the outlook for Singapore and Thailand with both countries likely to outperform in 2022 due to accelerating growth on the reopening of borders.

What trends will persist in 2022. There will be live television and radio coverage of the Budget Statement and a live webcast of its delivery will be available on the Singapore Budget websiteIt will also be published on the website after delivery. It can also be served as a show-cause notice to a GST practitioner for.

Export of goods and international services are. The rate will be. Electricity tariff for households to increase by 56 for the first quarter of 2022.

Goods and Services Tax Abbreviation.

The Gst Tax Rate Structure In India Download Table

Changes In Gst Rates On Services W E F October 1 2021 A2z Taxcorp Llp

Singapore Gst Treatment For Transactions Involving Digital Payment Tokens Bdo

What India Can Learn From Failure Of Malaysia S Gst

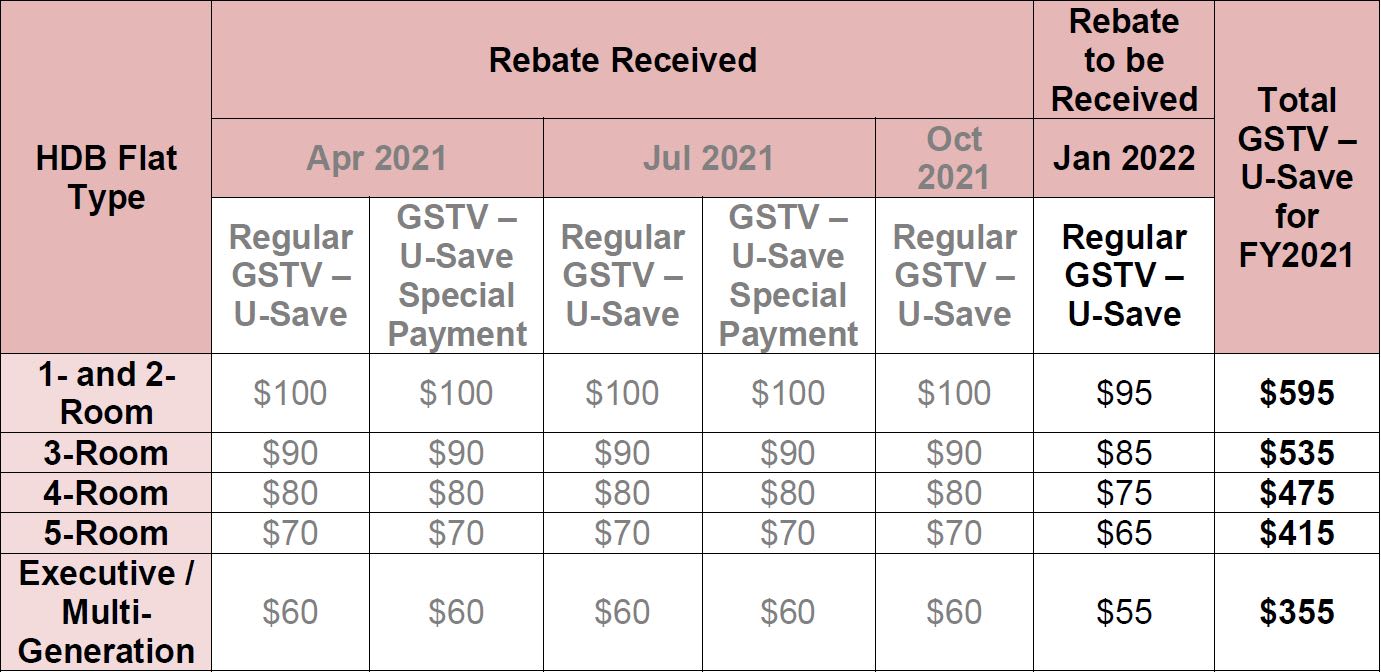

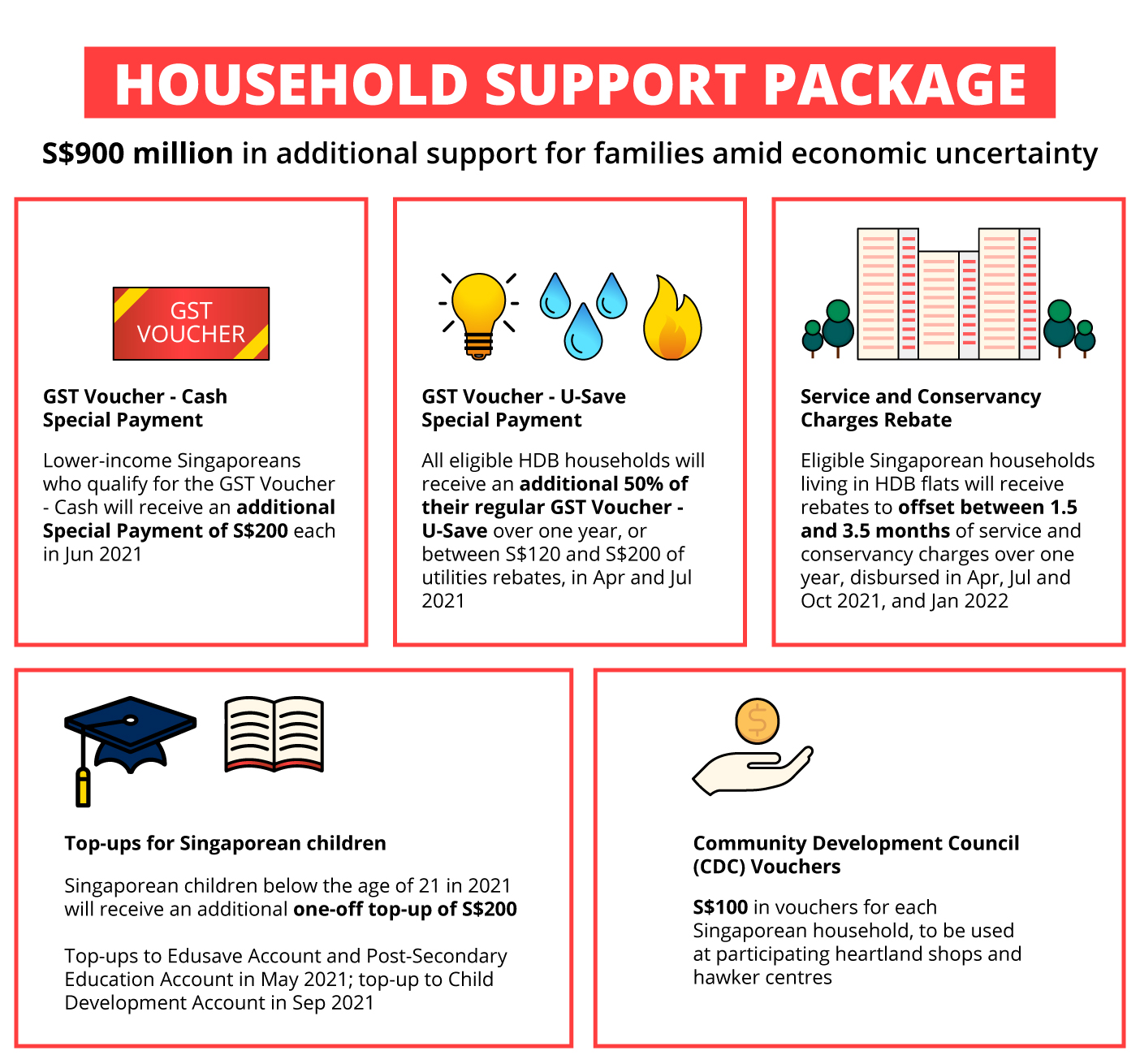

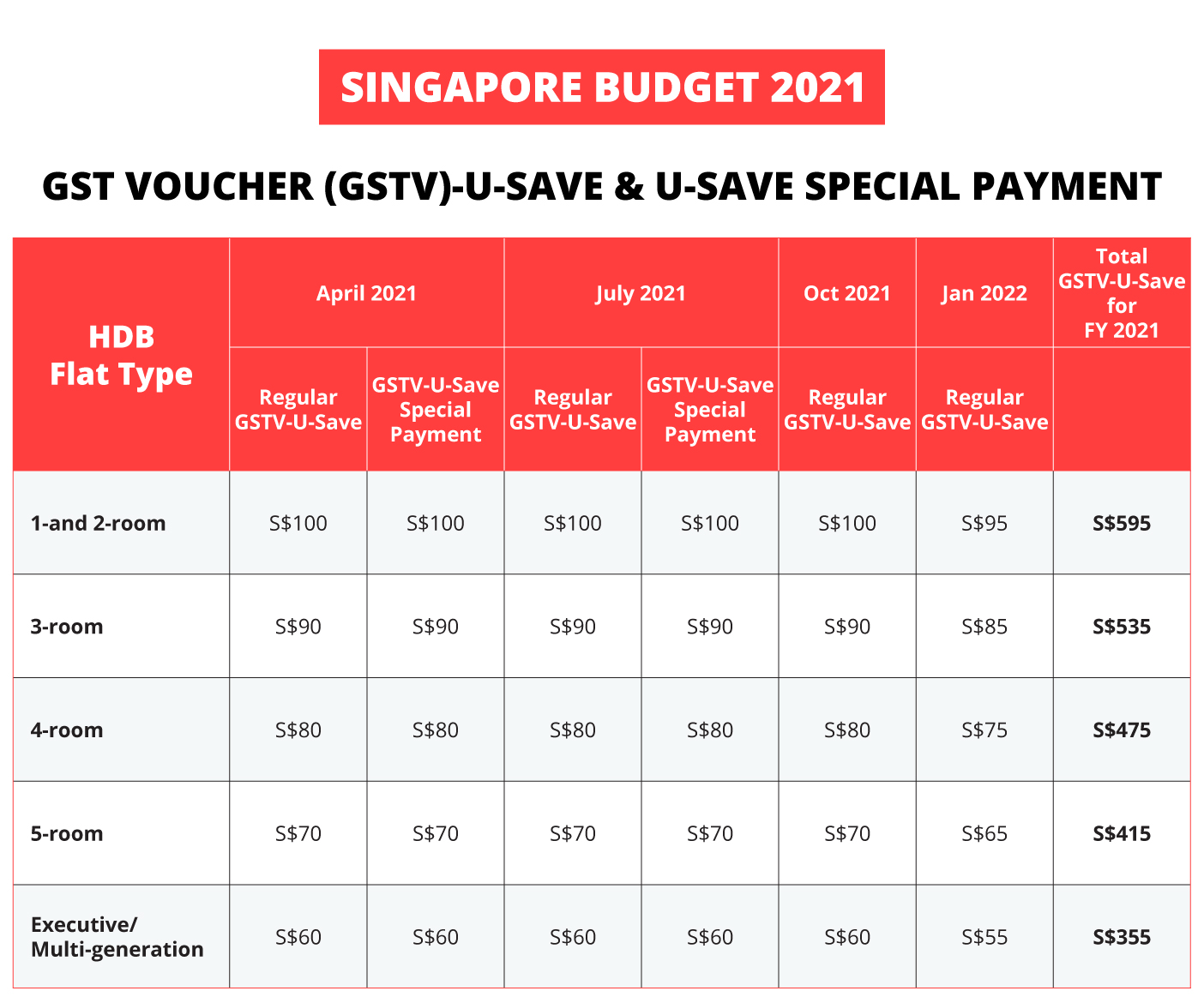

Budget 2021 More Help For Pandemic Hit Singaporeans Dbs Singapore

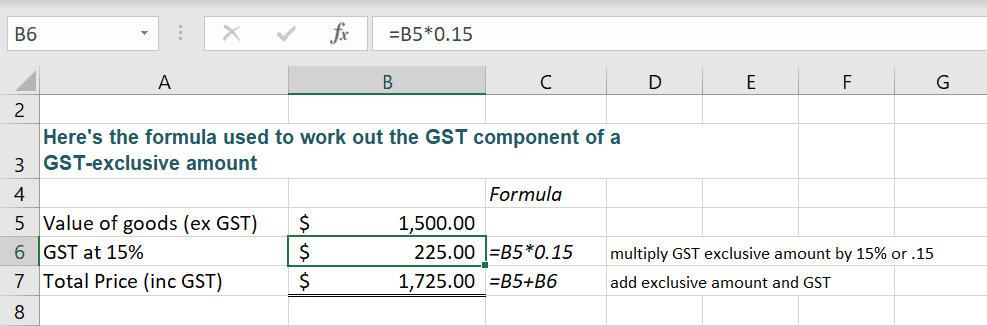

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

Gst Singapore A Complete Guide For Business Owners

Corporate Travel Corporate Travel Booking Hotel Vacation Packages

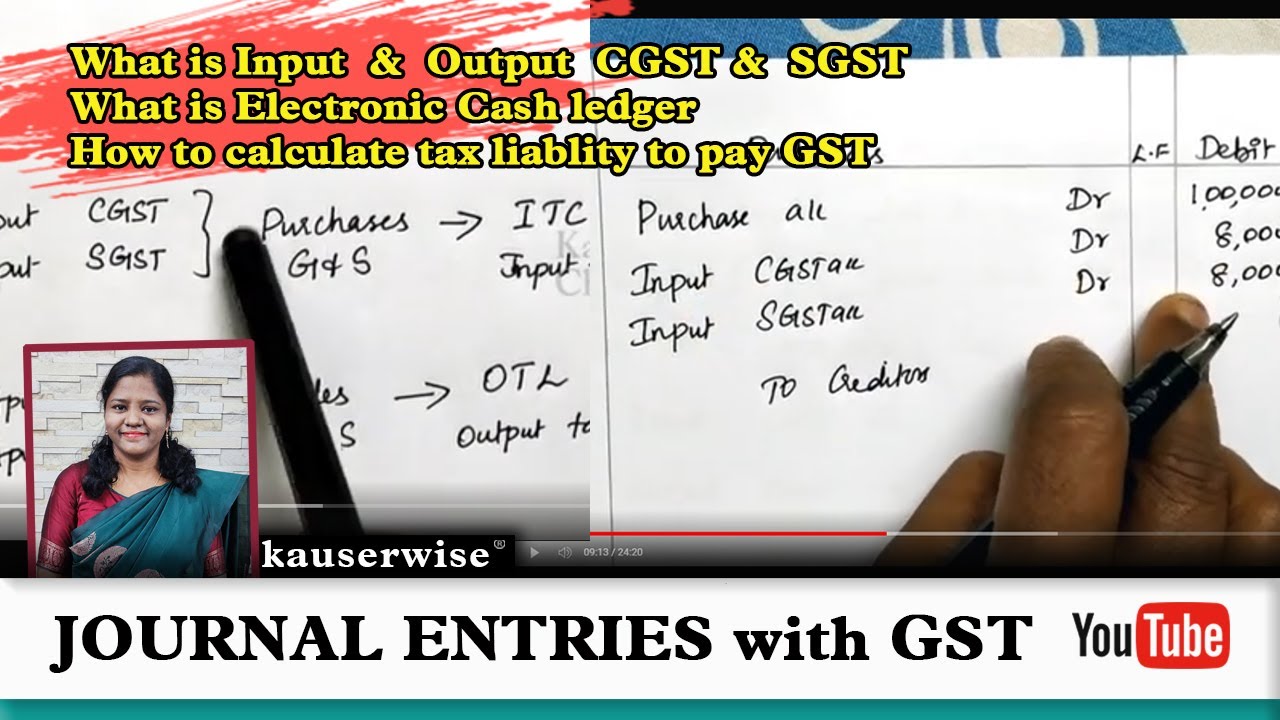

How To Make Journal Entries With Gst What Is Input Output Cgst Sgst Finding Tax Liability Youtube

Platform Operators Gst Hst Changes On July 1 2021 Kpmg Canada

India Number Of Gst Taxpayers In India 2020 By State Statista

46th Gst Council Meet On Dec 31 To Discuss Rate Rationalisation The Economic Times

India Monthly Gst Collections 2020 Statista

Retail 16000 Fire Sale 10000 Wire New Rolex Black Dial 31mm Oyster Perpetual Date Just With Yellow Gold And Diamonds Come Rolex New Rolex Oyster Perpetual

Budget 2021 More Help For Pandemic Hit Singaporeans Dbs Singapore